45 government zero coupon bonds

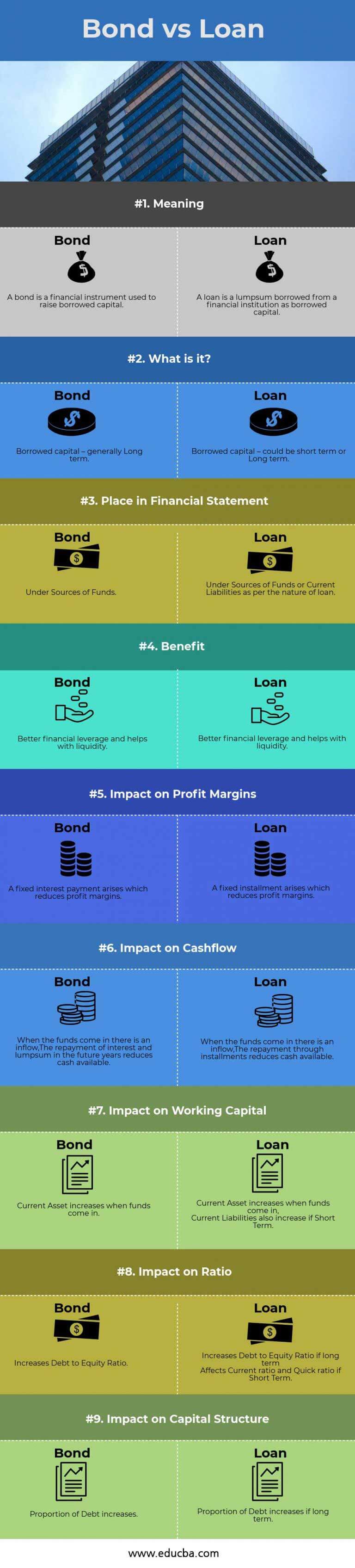

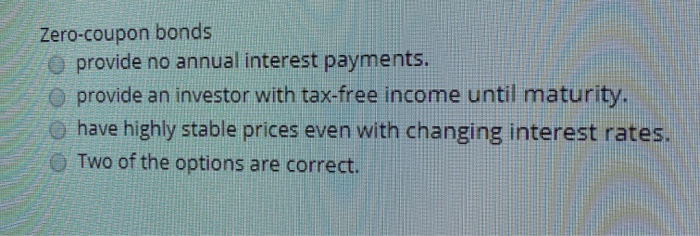

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

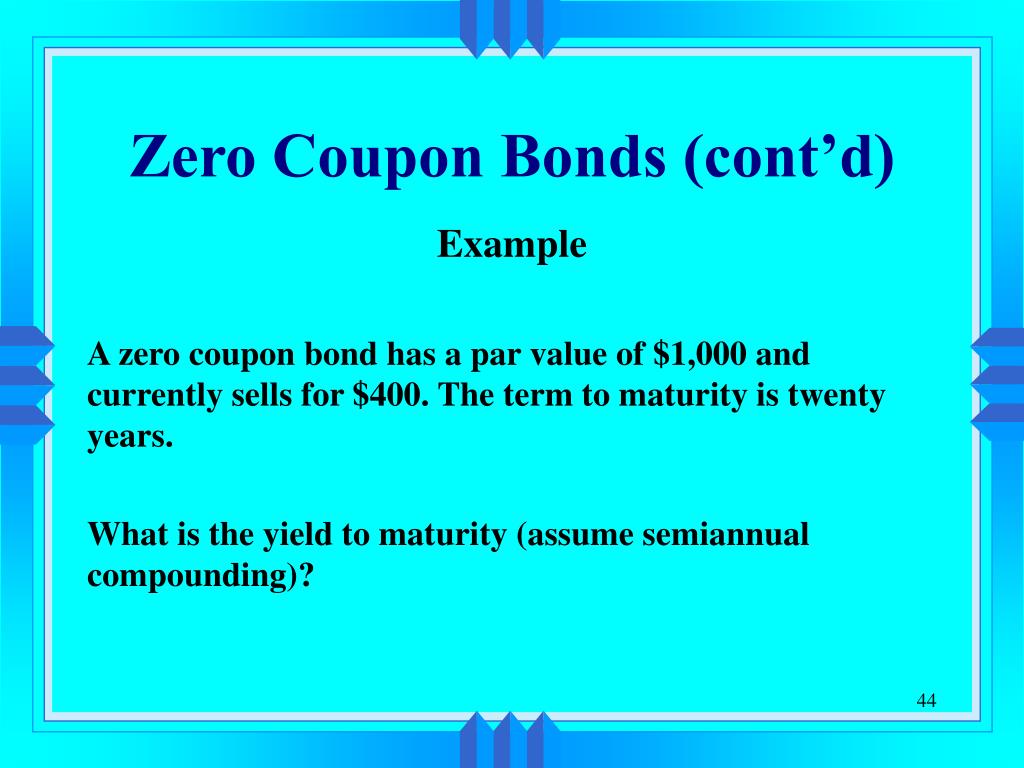

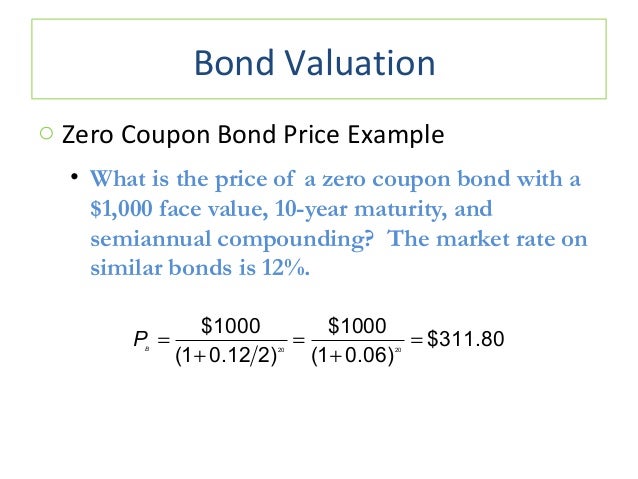

How Do I Buy Zero Coupon Bonds? | Budgeting Money - The Nest Step 5. Pay as little of the face value of your bond as you can to maximize your profit. For example, if a bond is worth $1,000 and you buy it for $800, you'll earn $200 in interest when the bond matures. But if you pay just $500 for the bond, you'll earn $500 at maturity. Zero coupon bond prices can fluctuate a great deal.

Government zero coupon bonds

Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ... India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.217% yield. 10 Years vs 2 Years bond spread is 66.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Government, Zero-Coupon & Floating-Rate Bonds - Study.com Treasury bonds are issued for 30 year terms and have a coupon payment, or interest payment, every six months. Payments continue for the 30 year duration, at which point the government pays the face...

Government zero coupon bonds. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Zero Coupon Bonds assures a fixed maturity amount after a certain period. Therefore, the investors who have want to get a fixed return in future with less market risk should go for these bonds. Even if you are an aggressive investor and always hunting for good stocks, you may still invest in these bonds to balance your portfolio. What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value ZERO COUPON GOVERNMENT BONDS - The Economic Times Public sector banks to get ₹15,000 crore via zero-coupon bonds in FY22 This comes even as some banks had reached out to the government seeking clarity given that the Reserve Bank of India has asked them to account for these bonds at fair value. 23 Feb, 2022, 01.35 PM IST RBI orders five banks to list zero coupon bonds at "fair value" zero coupon bonds: Govt's capital infusion via zero coupon bonds ... With the zero coupon bonds, the banks will not benefit from that income. Since FY18, the government has used recapitalisation bonds with banks subscribing to them with a maturity ranging between 10 and 15 years, and coupon rates of 7.4 per cent-7.7 per cent. The government would then use the funds raised to be infused back in PSBs as equity. How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

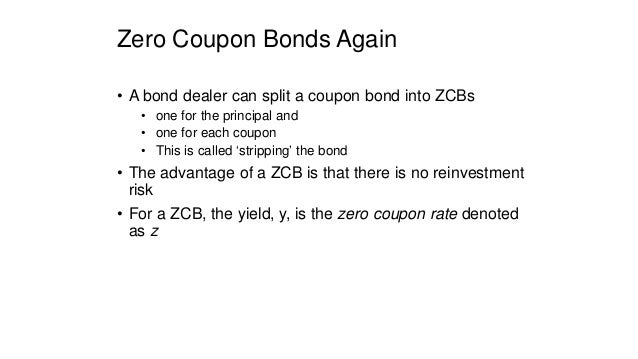

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. What are Zero Coupon Bonds? - Civilsdaily Zero-Coupon Bonds. These are non-interest bearing, non-transferable special GOI securities that have a maturity of 10-15 years and are issued specifically to Punjab & Sind Bank. These bonds are not tradable; the lender has kept them in the held-to-maturity (HTM) investments bucket, not requiring it to book any mark-to-market gains or losses ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. How to Invest in Zero-Coupon Bonds - US News & World Report Zero-coupon bonds live in the investing weeds, easily ignored by ordinary investors seeking growth for college and retirement. Even fixed-income investors may pass them by, because they don't...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks The US federal government, various municipalities, corporations, and financial institutions all issue zero-coupon bonds. The majority — what most people refer to as zeros — are US Treasury issues....

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.623% yield. 10 Years vs 2 Years bond spread is -17.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Zero Coupon Yield Curve - The Thai Bond Market Association Zero Coupon Yield Curve Zero Coupon Yield Curve 0 10 20 30 40 50 60 TTM (yrs.) 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 Yield (%) ThaiBMA Zero Coupon Yield Curve as of Wednesday, August 24, 2022 ThaiBMA Government Bond Yield Curve as of 24 August 2022 Export to Excel Remark: 1.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide The absence of regular periodic payments is what makes zero-coupon bonds different as compared to other types of bonds. Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero ...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with ...

Zero-Coupon Bond: Formula and Calculator [Excel Template] U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage...

Government, Zero-Coupon & Floating-Rate Bonds - Study.com Treasury bonds are issued for 30 year terms and have a coupon payment, or interest payment, every six months. Payments continue for the 30 year duration, at which point the government pays the face...

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.217% yield. 10 Years vs 2 Years bond spread is 66.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ...

Post a Comment for "45 government zero coupon bonds"