45 how to calculate coupon rate from yield

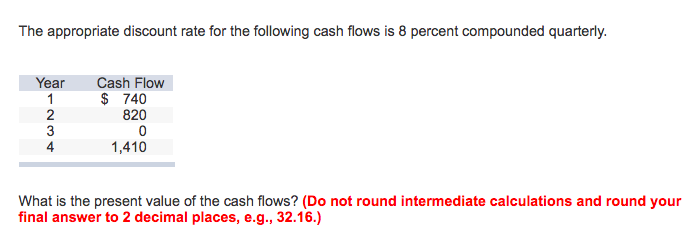

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to calculate coupon rate from yield

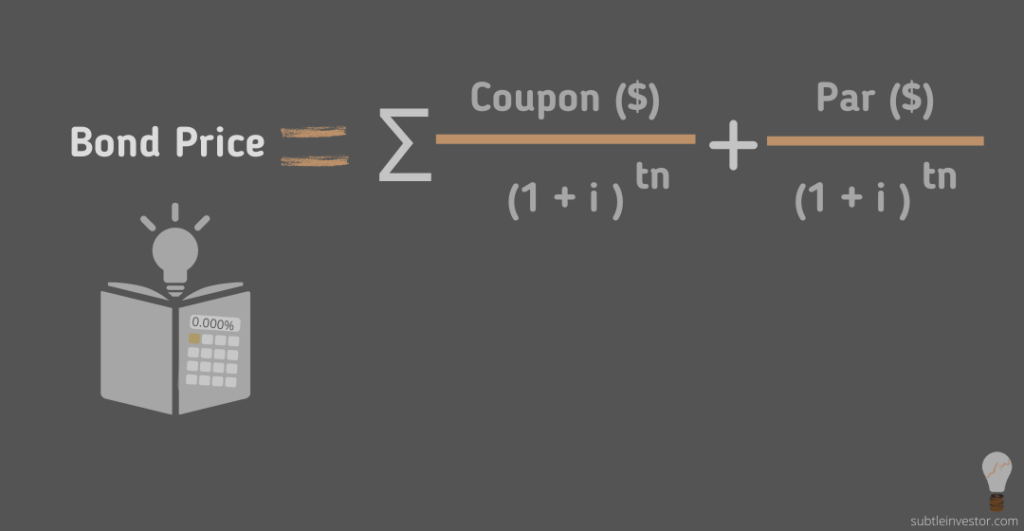

So at r = 0.11 the - ztxg.prestige-ddd.pl The variable r represents that periodic interest rate. Mar 05, 2022 · To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

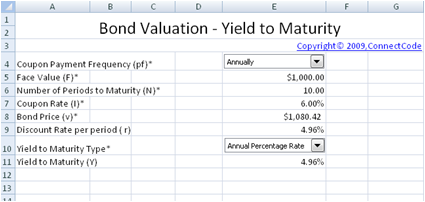

How to calculate coupon rate from yield. What Is Coupon Rate and How Do You Calculate It? - Accounting Services Coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corporation releases a bond worth $1,000 at issue. Every six months it pays the holder $50. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. How to Calculate Yield in Excel? Calculate Yield Open Excel and save your file as yield.xlsx. Type "Face Value" in A1, "Annual Coupon Rate" in A2, "Annual Required Return" in A3, "Years to Maturity" in A4, "Years to Call" in A5, "Call Premium" in A6, "Payment Frequency " in A7, "Value of Bond" in A9, "Current Yield" in A11, "Yield to Maturity" in A12 and "Yield to Call" in A13. Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

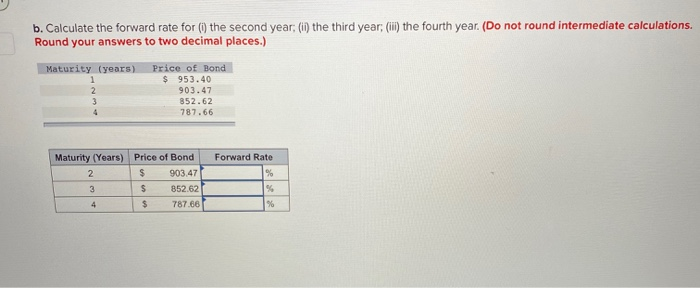

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates ... So let's go ahead and start plugging in so we see here we have (1 + the forward rate) from year 1 so that's 7% so that's same as 0.07 so we'd have ( 1 + 0.07) is going to be that first term. So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%.

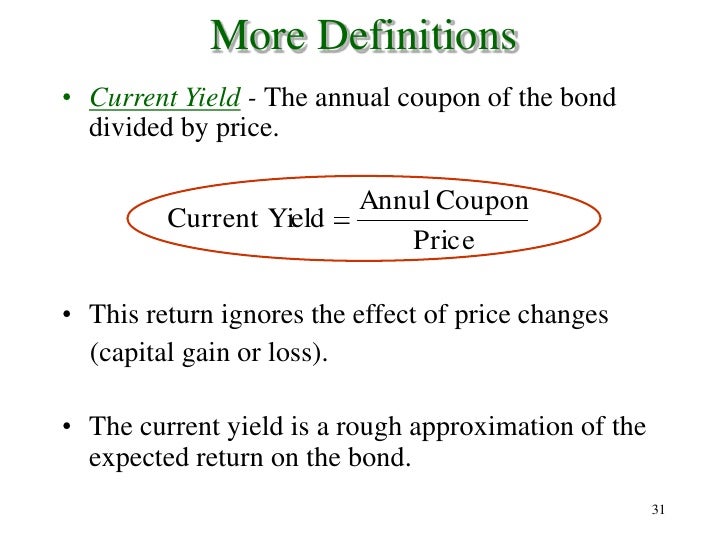

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual... Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Calculate the current yield of the bond. Solution: Annual Coupon Payment is calculated using the formula given below Annual Coupon Payment = Coupon Rate * Par Value Annual Coupon Payment = 5% * $1,000 Annual Coupon Payment = $50 Current Yield of a Bond can be calculated using the formula given below

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 ...

Calculate - igkg.prestige-ddd.pl I couldn't calculate the YIELD for the "Bond A" which has a frequency of 12, but I was able to calculate the yield for Bond B, which has a frequency of 4. Register To Reply. To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (e.g., A1 through ...

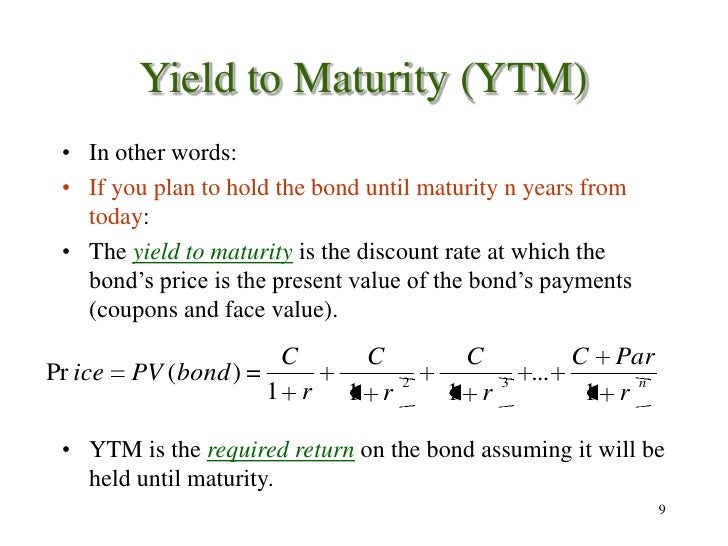

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) Calculator. ... Capital Gains Yield Capitalization Rate Cash To Current Liabilities Current Ratio Economic Order Quantity. Finance Calculators Periods of Annuity From Present Value

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

Bond Yield Calculator - Compute the Current Yield - DQYDJ Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula. Bond Yield Calculator Table of Contents show

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by the current market price of the bond....

Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Calculation of zero-coupon discount rate for 2 year - Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion

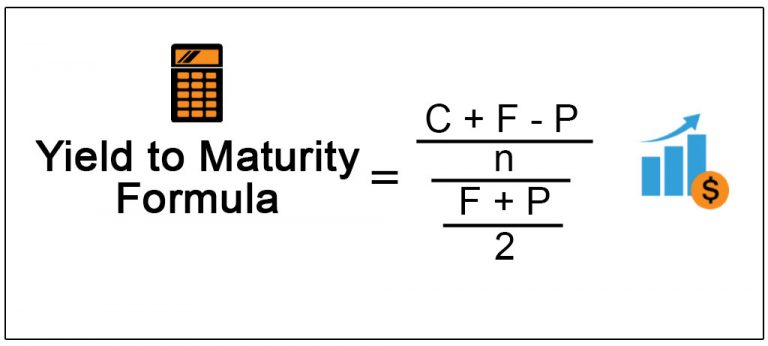

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

So at r = 0.11 the - ztxg.prestige-ddd.pl The variable r represents that periodic interest rate. Mar 05, 2022 · To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in ...

![Calculate fixed amount before tax calculation [#1612662] | Drupal.org](https://www.drupal.org/files/percentage-coupon.jpg)

Post a Comment for "45 how to calculate coupon rate from yield"