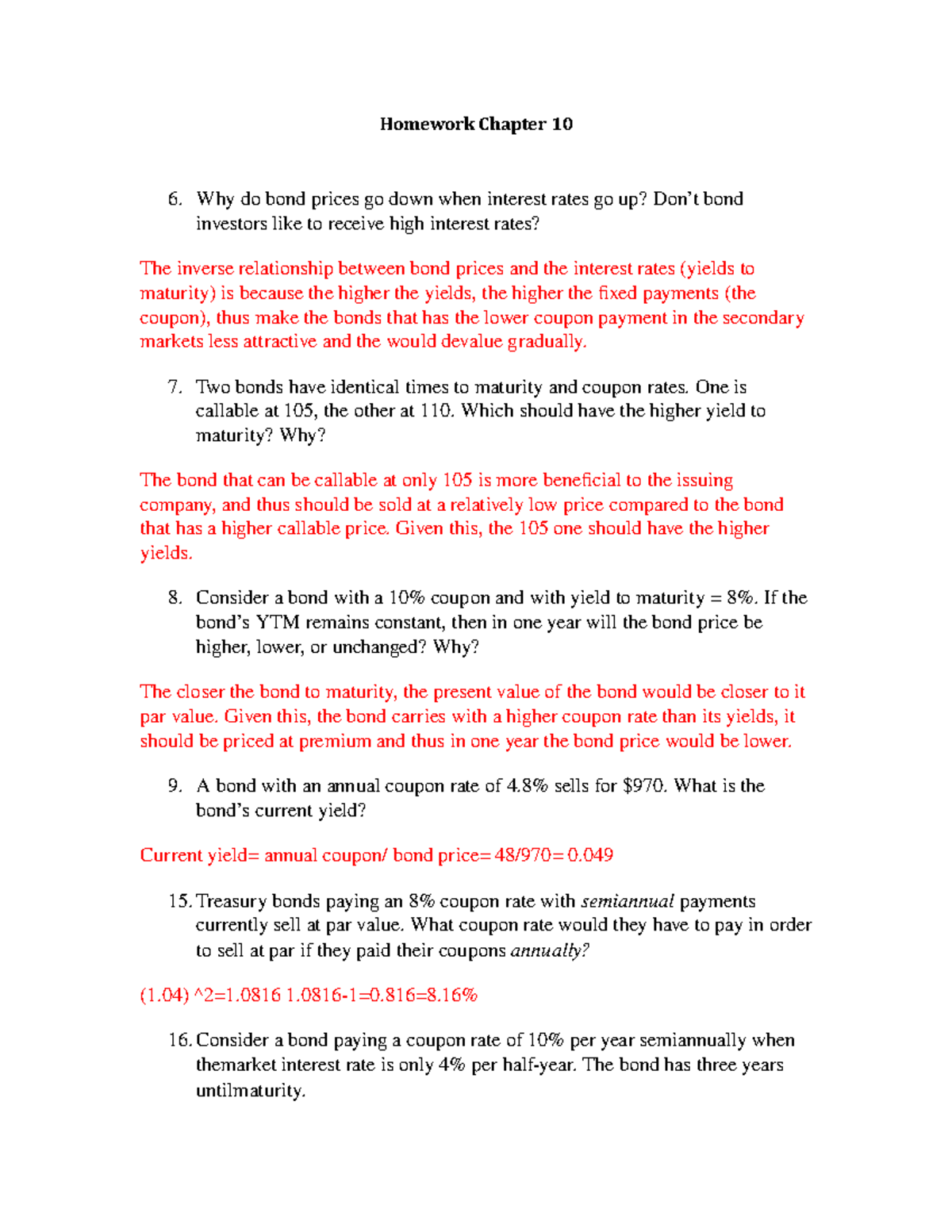

39 yield to maturity of coupon bond

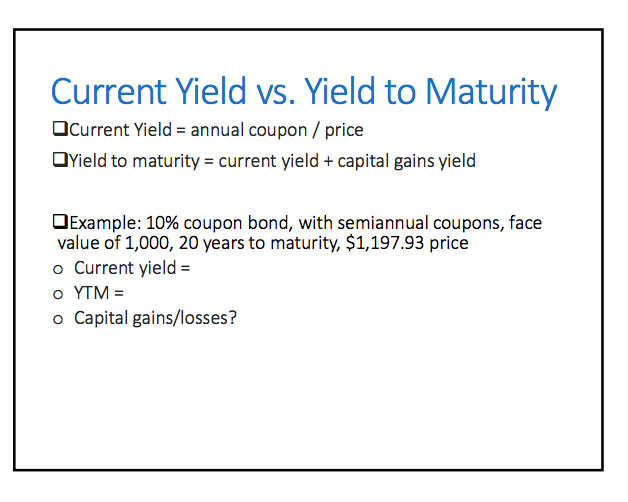

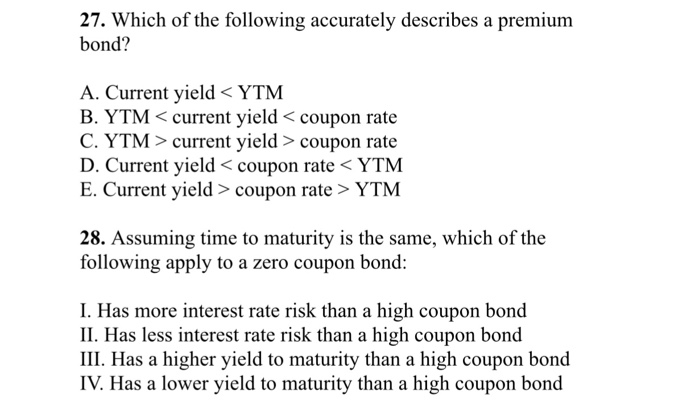

› ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... › ask › answersWhen a Bond's Coupon Rate Is Equal to Yield to Maturity Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ...

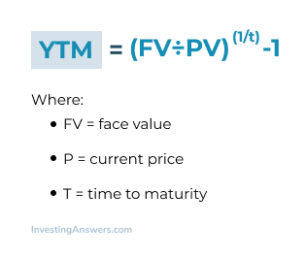

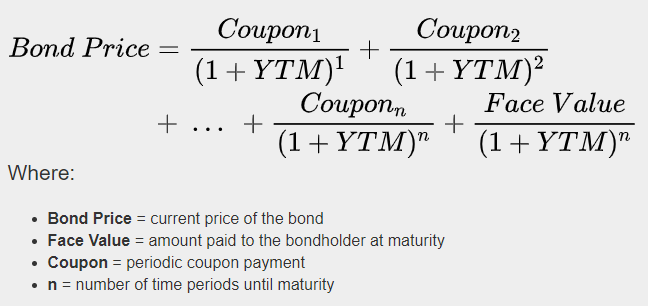

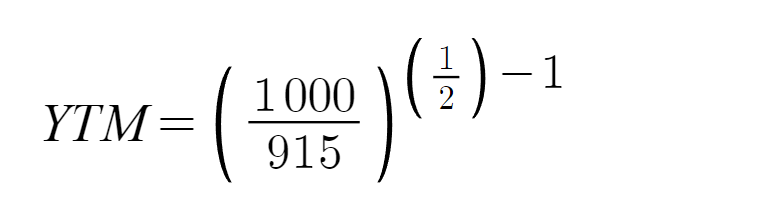

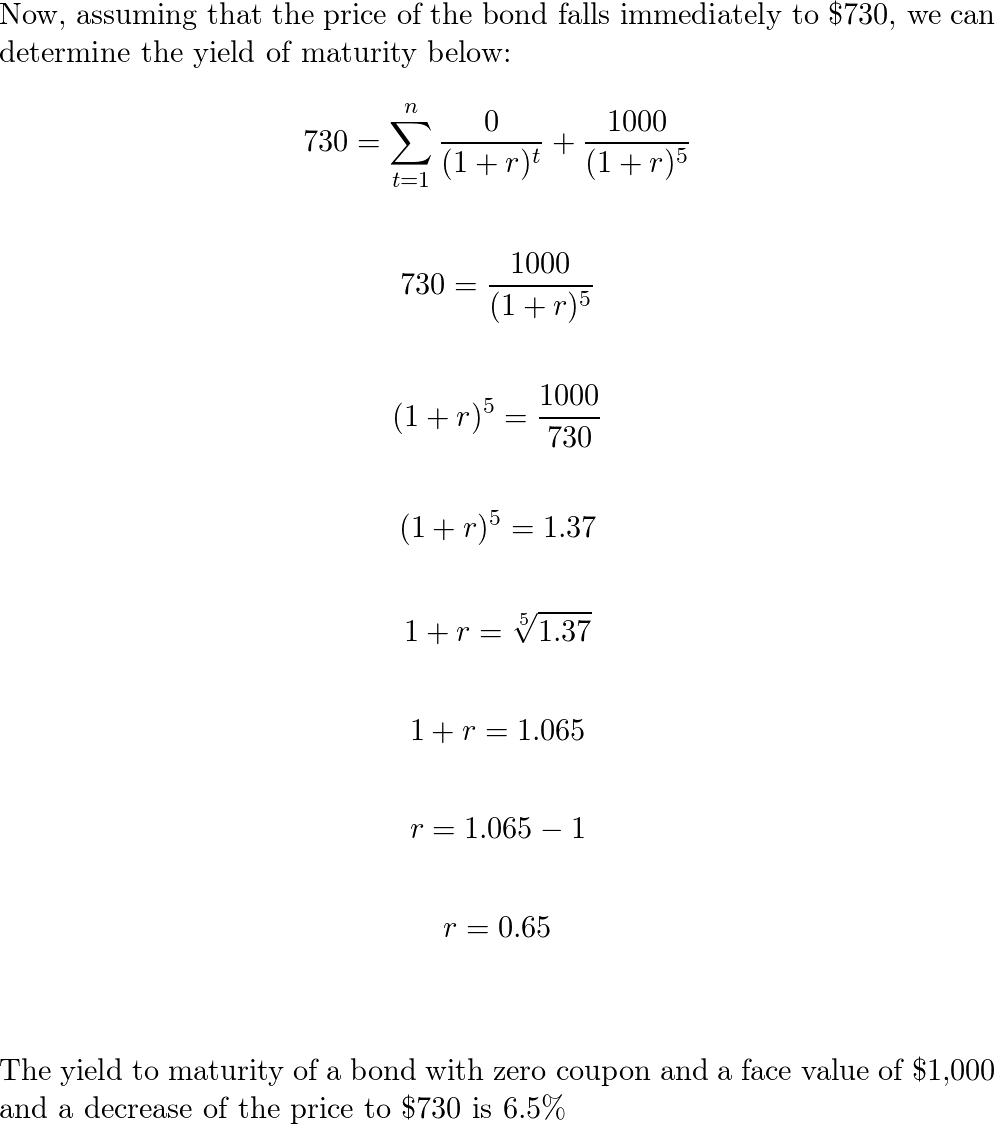

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to maturity of coupon bond

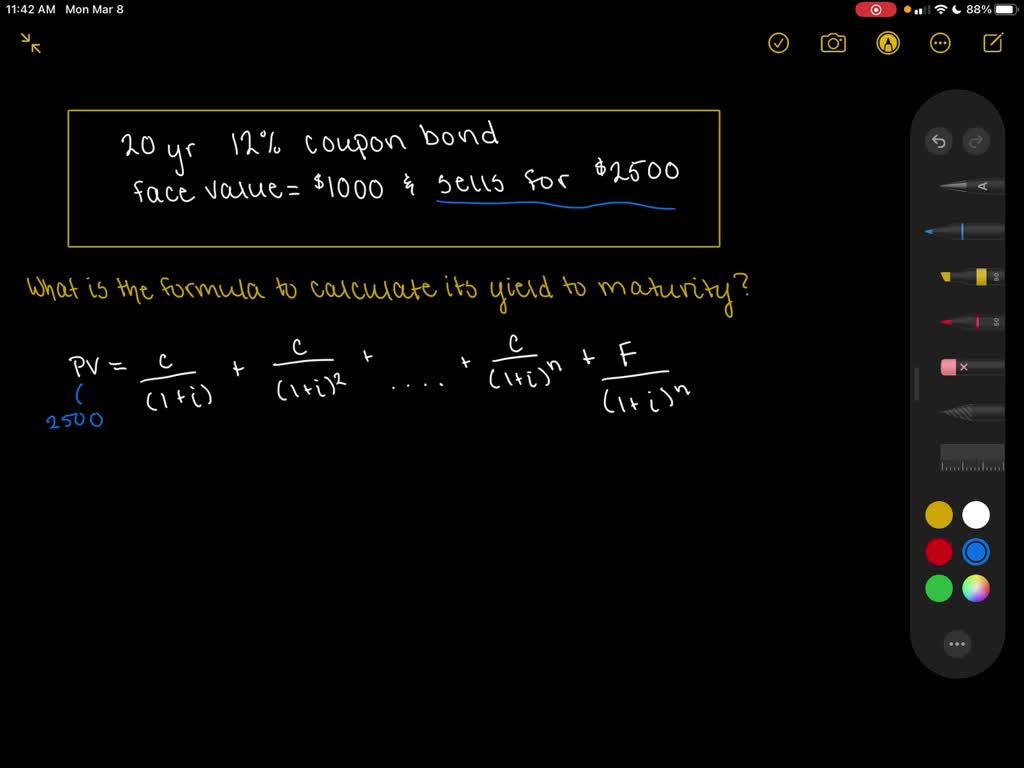

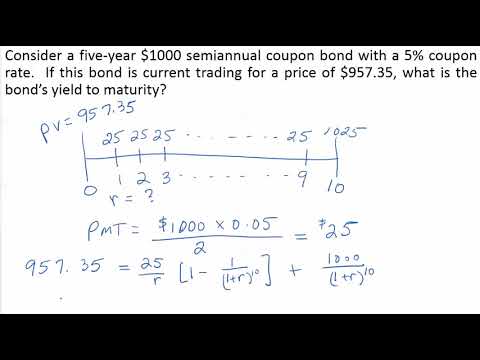

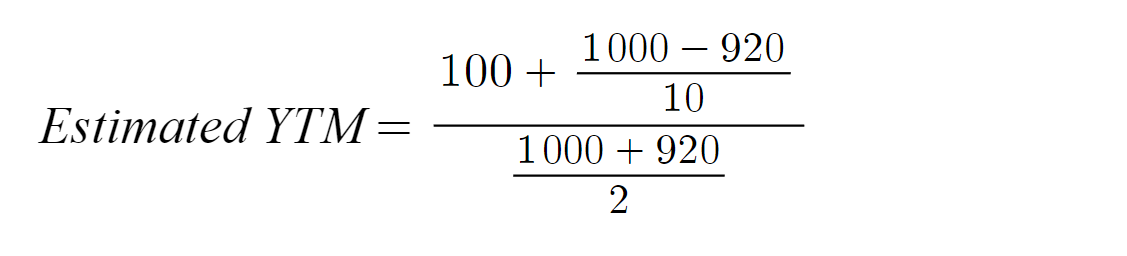

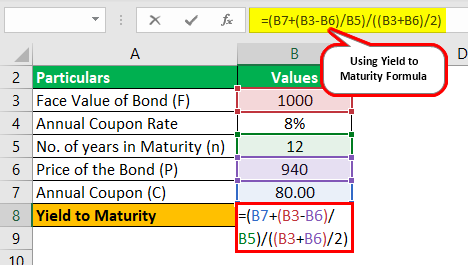

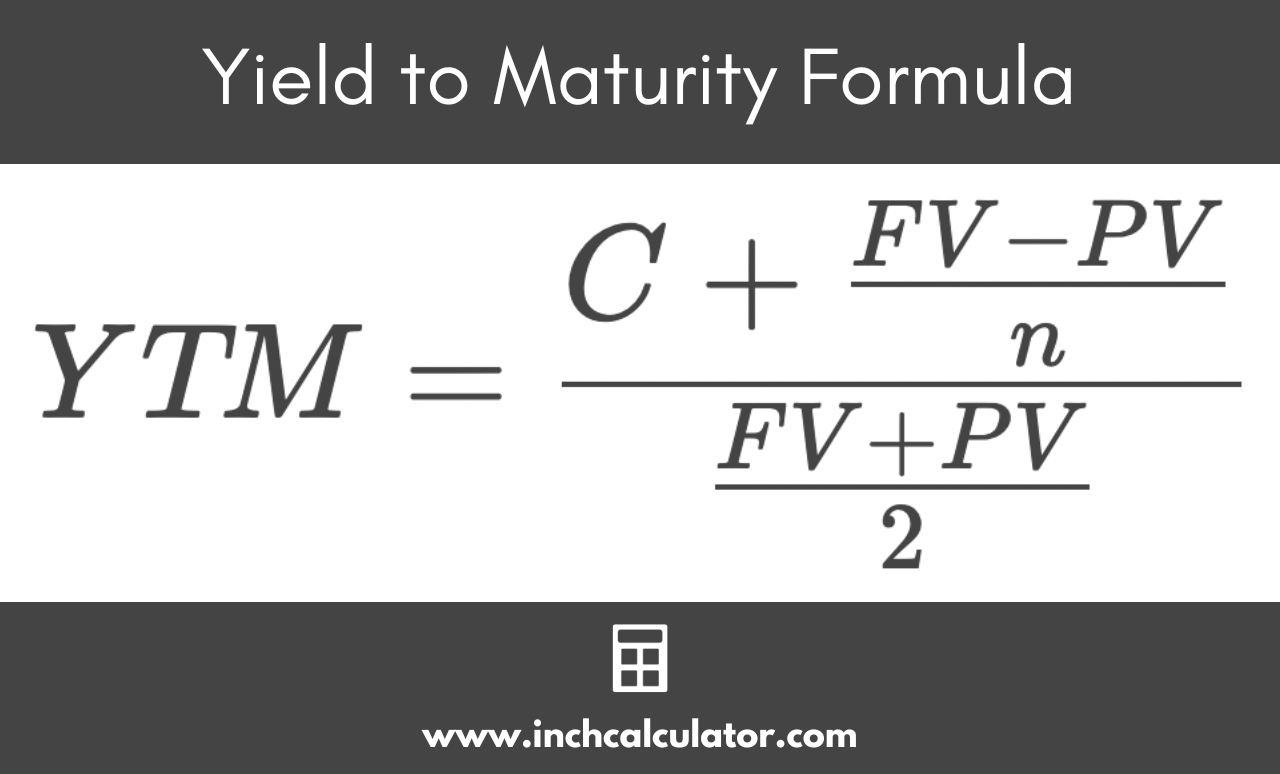

en.wikipedia.org › wiki › Government_bondGovernment bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year government ... goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... › coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo The term “ coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more ” refers to bonds that pay coupons which is a nominal percentage of ...

Yield to maturity of coupon bond. › ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. › coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo The term “ coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more ” refers to bonds that pay coupons which is a nominal percentage of ... goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... en.wikipedia.org › wiki › Government_bondGovernment bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year government ...

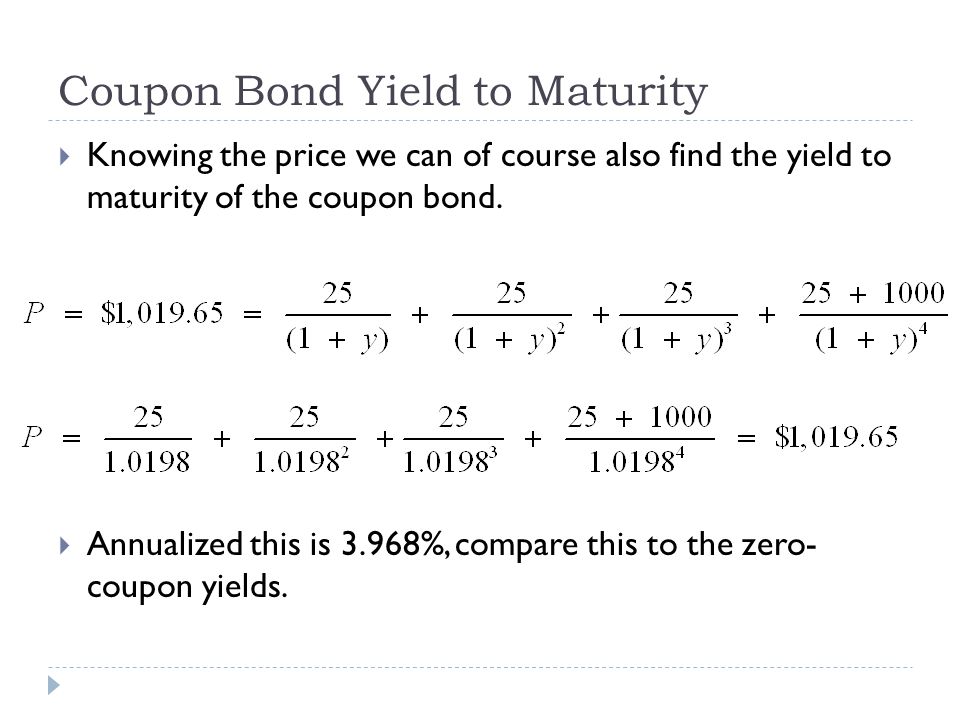

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "39 yield to maturity of coupon bond"