45 step up coupon bonds

Are step-up bonds good protection against rising rates? These are bonds where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series too. These are also called as a dual coupon or multiple coupon bonds. These are just the opposite of Step-Up Bonds. These are bonds where the coupon usually steps down after a certain period. What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond.

PDF Understanding Callable Step-up Investment Products Multi Step-Up A multi step-up bond may adjust many times during the life of the investment, if it is not called. For example, a 15-year multi step-up certificate of deposit may begin with a coupon rate of 5.00 percent in year one and adjust in increments to reach 13.00 percent in year 15. Typically, the coupon paid on a callable step-up bond is

Step up coupon bonds

What Is a Step-up Bond? But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Step Up Bonds: Pros and Cons Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period.

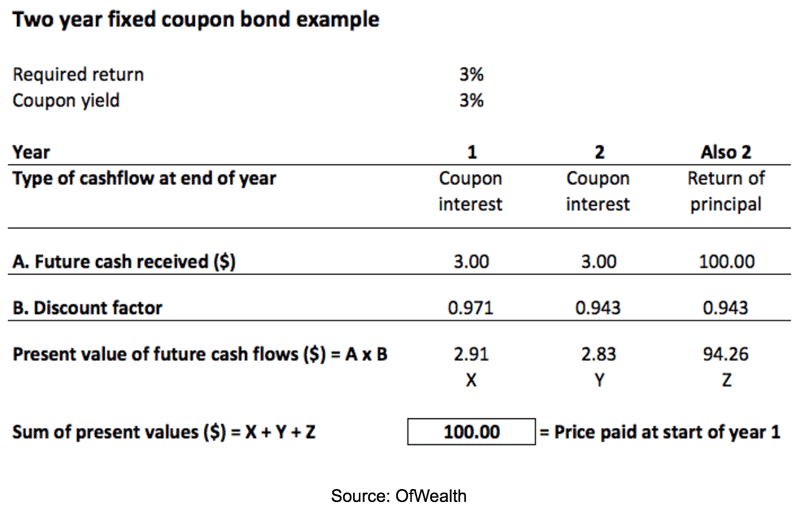

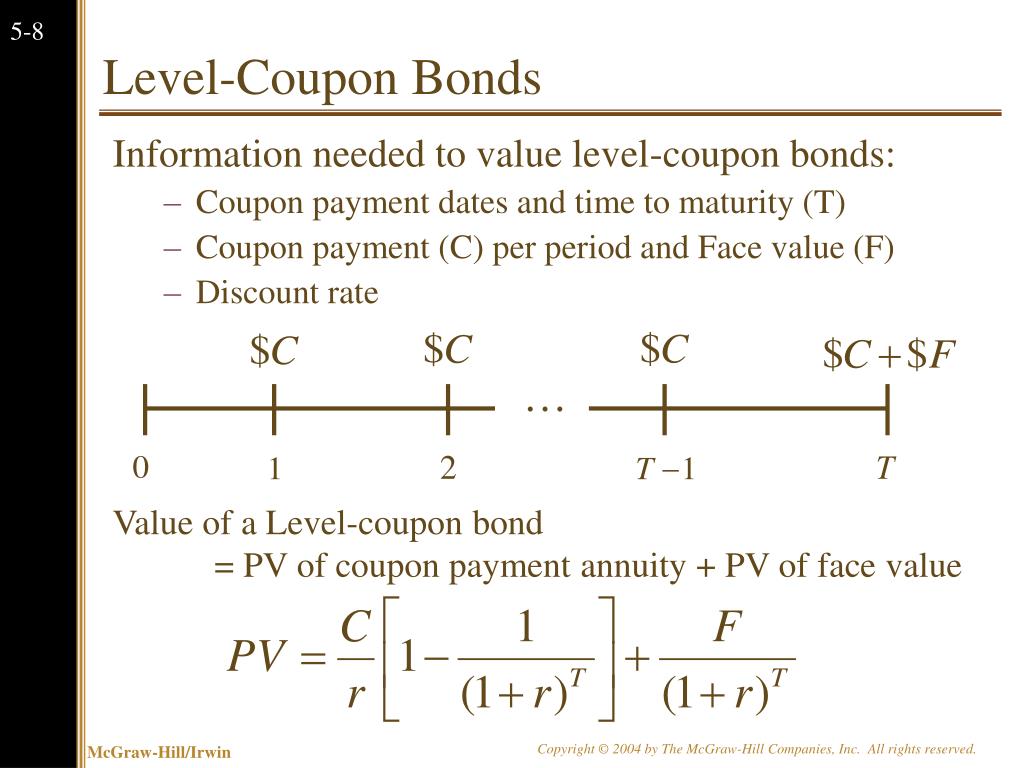

Step up coupon bonds. What are Step-up Bonds? Example, Types, Advantages, and ... - CFAJournal The coupon rate of the bond increases to 5% in its final year. It means the lender will receive $30 for each of the first two years, $45 for year two and year three, and finally receive $50 in the last year. The lender will also receive $1,000 on the maturity of the bond, as usual. Types of Step-Up Bonds Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments. equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Step-Up Coupon Bond | Derivative Valuation, Risk Management, Volatility ... A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases. CH 7 Step up bonds.docx - Introduction to Step-up Bonds: At... Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period. Step-up bonds may reset once or reset multiple times ...

Stepped Coupon Bonds financial definition of Stepped Coupon Bonds stepped coupon bond. A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is ... Protecting investors from interest-rate risk with step-up bonds Step-up bonds are special types of bonds that offer a lower interest rate at the beginning with a provision for an interest rate increase after a certain period. The number and level of the rate increase, as well as the timing, depends on the bond terms. The step-up bonds may have a single interest rate rise or multiple interest rate rises. Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). › Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · Interest is paid semi-annually, so the coupon rate per period is 5 percent (10 percent / 2) and the market interest rate per period is 4 percent (8 percent / 2). The number of periods is 10 (2 periods per year * 5 years). The coupon payment per period is $25,000 ($500,000 *.05). Calculate the present value of the principal.

Types of bonds based on cash flows - Fixed Income - AlphaBetaPrep A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value. Step-Up & Step-Down Bond Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond. › terms › zZero-Coupon Bond Definition - Investopedia Feb 26, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › Redeem-Savings-BondsHow to Redeem Savings Bonds: 9 Steps (with Pictures) - wikiHow Apr 04, 2022 · Savings bonds earn interest during each year of ownership. For Series E/EE bonds, there is a choice for how to report interest as taxable income. Interest can be reported every year, but if this is done for one year, it must be reported every year until it reaches final maturity or until the bond is redeemed, whichever comes first.

Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S. 674.

› vouchers › step-oneStep One Discount Codes: 10% Off - May 2022 - Groupon Enjoy FREE Australian Shipping at Step One: Online Deal: 30 May 2022: Limited Edition ⚡️ Shop the New Pinkmosis at Step One: Online Deal: 30 Jun 2022: New Golden Nuggets Colour Now Available at Step One: Online Deal: 29 Jun 2022: Mix N Match | Get 4 Pairs For Just $27 at Step One: Online Deal: 29 Jun 2022: You Join the Club! and Get 10% Off ...

Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds, Benefits-Risks Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Accounting for Step-Up Bond - Advantage - Accountinguide Step Up Bond provide benefit to the holders while having some negative impact on the issuers. Step Up Bond Example Company ABC issues the step-up bond at $ 1,000 per bond. The initial coupon rate was 2%, and it will keep increasing 50% every year over the 5 years lifetime.

Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Step-Up Bonds Definition & Example | InvestingAnswers A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ.

investinganswers.com › dictionary › bBond | Meaning & Examples | InvestingAnswers Nov 25, 2020 · If new bonds are issued with interest rates of 7%, your bond will return less than newly issued bonds (your coupon of 5% is less than the new rates of 7%). These new bonds will be more attractive to investors and demand for them will increase, causing older bonds’ prices to fall: your bond value drops, but your expected future cash flow does ...

› fixed-income-bonds › individualFidelity Corporate Notes Program - Buy Bonds Direct Step-up Coupon: If your Corporate Note has a step-up coupon schedule, the interest rate of your Corporate Note may be higher or lower than prevailing market rates. Generally, a step-up Corporate Note pays a below-market interest rate for an initial defined period (often one year).

Step-Up Coupon Bond - Harbourfront Technologies A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases.

What Is a Coupon Bond? A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to...

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate Calculation (Step by Step) The coupon rate can be calculated by using the following steps: Firstly, figure out the face value or par value of the issued bonds Bonds Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more .

Stepped coupon bond financial definition of stepped coupon bond A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change.

Raymond James Financial | Services and Products | Bond Basics | Types of Income | Step-Up Bonds

Deferred Coupon Bonds: Definition, How It Works, Types and More Step-Up Bonds These bonds do not make coupon payments until a certain period. For instance, a bond can start interest payments after 5 years with a 10 year maturity period. Toggle Notes Toggle notes pay increased interest rates after a certain period. Investors expect higher interest rates with a deferred payment condition.

Sustainability-linked bonds: The investor perspective | Nordea When ENEL issued the inaugural sustainability-linked bond in 2019, it included a coupon step-up of 25 bps as a financial penalty if the company's SPTs were not met. Since then, using coupon step-ups as a financial characteristic has become the market standard in the SLB space.

Deferred Coupon Bonds | Definition, How it works? Types, Advantages These deferred interest bonds pay interest on maturity at a single coupon rate. Assume a bond with an annual yield of 5% and its coupons deferred till maturity. At maturity, the investor will be paid the principal of the bond. Along with this, 5% interest for the total deferred period is also paid. Step-up Bonds

Post a Comment for "45 step up coupon bonds"